You’ve got a sales team that works – they jive well together, bring in the money, engage leads and partners, and your organization has been more-or-less seeing sales growth. But, what if you could do more? What if…you could tune just a couple of things that will get the team to boost sales numbers by 20% to 40% more? Sound far fetched? It really isn’t…by monitoring sales performance metrics you can easily spot opportunities for boosting sales growth.

Always remember, the purpose of smart sales metrics isn’t to play blame games or report for the sake of reporting. It’s to ask critical questions on how to do something better from a skills development or process optimization perspective.

Most sales & marketing teams have a hard time measuring KPIs due to a lack of understanding & purpose behind what to measure. I’ll make the purpose of every KPI very clear, in plain language, based on what the top B2B sales teams actually care about.

Playlist pairing: Coffee House Music

Summary | In Case You’re Crunched for Time

- What is a sales KPI: a sales KPI measures how successful an organization is at achieving its sales objectives.

- Productivity Metrics: measure the basic work quotas your team needs to meet in order to keep momentum. Typically measured by calls, emails, meetings & demos made.

- Sales Intelligence Metrics: lets you understand where your team needs coaching in either product/service knowledge, sales process & tool/tool usage or relationship building.relationship building skills.

- Performance Metrics: the result of hard productivity & sales intelligence, performance is typically measured via sales cycle stage conversions & ratios.

- Conversion & Pipeline Metrics: understand the effectiveness of your sales process and which sales stages need optimization. Measured a conversion %, ratios of team averages and individual performance.

- Forecast Metrics: confidently estimate your future sales based on past performance. Measure by analyzing average; sales cycle duration, profit margin, deal size & cost per lead.

- Customer Metrics: happy customers account for over 60% of B2B revenue, know your advocates, boost upsells & client retention.

- Marketing to Sales Metrics: optimize the quality of leads flowing from marketing to sales.

- Goal and KPI matching: the process of describing which KPI we’ll use to measure business success, you don’t need a million goals. What’s important is to have meaningful and attainable goals that can be actioned by your sales team. Basic goal examples are; increasing revenue (duh), productivity, impact & influence.

- Learn more, sell better: a collection of sales & marketing insights you actually care about

What is a B2B sales KPI ?

What it is: KPIs measure an organization’s progress to attain specific goals set by the sales team. They help measure performance and uncover opportunities for improvement in sales skill & internal process. KPIs must be continuously monitored and actively optimized for improvement. Examples of KPIs: pipeline conversion rates, cost per acquisition, pipeline velocity, win rate, etc.

What it is not: metrics are often confused with KPIs. Metrics enrich/support KPIs, they are stand-alone numbers that don’t serve a direct business objective. KPIs are metrics that tie directly to supporting organizational goals & objectives. Examples of metrics: number of phone calls, content downloads, number of emails, total website traffic.

1. Productivity

Productivity metrics measure how effective your team is at navigating your sales process. Typically, productivity measures the communication between sales reps, prospects and customers – measured via activity counts & deviations from baseline.

Here are the questions you should be aiming to answer:

- Is your sales team efficient with their time use? And,

- Are they focusing on high-impact activities that drive the business forward?

System Touch Averages

How many calls, emails, demos, meetings and content has the sales rep shared with the prospect? And, are your sales reps meeting their minimum activity quotas?

What I typically do is cross-reference the system touches to the size & nature of the deal that was won. As some deals inevitably have longer-cycles, meaning more overall touches, just remember to compare like-to-like.

- Why you care: Understanding the average amount of sales touches required to close a deal allows you to set a baseline to track against. This way you will know when activity is too low and too high in order to continue optimizing your sales approach. It goes without saying that you need consider deal complexity alongside average # of touches.

- Sanity check: Based on your closed-won deals, count how many overall touches you’ve had with the customer, do the same for closed-lost deals. Then, create these dynamic/smart lists in your CRM:

- Common touch types: email, phone, meetings, demos, newsletters.

- Low touch, high conversion: understand the commonality between closed-won accounts that have been efficiently closed. Great for knowledge sharing.

- High touch, high conversion: understand the commonality between closed-won accounts that have more than average touches.

- High touch, low conversion: understand if a sales rep needs skill development in either prospecting or nurturing. What touches are inefficient or not relevant?

- Low touch, low conversion: you’ll understand which sales rep is not engaging frequently and/or relevantly enough.

- Formula: Average system touches = amount of system touches for closed-won deals / # of closed-won deals (also, break this down by the type of touches).

Lead Response Times

Are your sales people engaging quality online leads fast enough, or are your prospects sitting all alone in digital space…ripe for picking? Lead response time is the average amount of time between lead creation and when they are first responded to by sales reps. Out of 2,200+ businesses studied, Harvard Business Review found that on average B2B businesses take about 42 hours to respond to online sales leads.

- Why you care: the shorter your response time, the higher your chance of selling. By engaging leads fast, your chances of earning business jump up by 50%. Remember, if someone is engaging you for information or a demo, they’ve most likely -at the same time- engaged your competitor. So..whoever gets to them first, in a caring manner while showing value…will most likely get the biz.

- Sanity check: when a lead is assigned, a sales rep should be on the phone or emailing them within the hour (naturally, take into context what you sell).

- The formula: Average lead response time = (first lead response date – date lead is created) / total # of leads responded to

Average Follow up Attempts

Do your sales reps follow up enough times to ensure a prospect isn’t missed out on? Most sales people give up too easily after an average of 2 follow up attempts, the top sales teams swear by about 8 to 12 attempts.

- Why you care: leads are expensive to acquire, they’re even more expensive to lose. Ensure your sales reps are staying on top of the lead’s mind and are not burning through potential sales.

- Sanity check: Don’t annoy your prospect by following up too frequently within a short period of time. As a B2B business, we recommend keeping phone follow ups a minimum of 2 days apart. The gaps in time may be enriched with LinkedIn connections & emails.

- Formula: Average # of follow-up attempts = Total # of follow-up attempts / total # of leads

CRM System Tip: Use the field “Last Contacted” to help you with most engagement tracking lists & follow up creation workflows.

Although last contact is not a KPI, I think of it as an enrichment number that will help your sales team be more active with their prospects. Are your sales reps letting contacts go stale? Does the sales team have the necessary CRM setup to help them follow up with contacts after they have initially engaged them?

- Why you care: Unless you want to be giving money away, ensure your reps have a healthy prospect & client engagement repertoire.

- Sanity check: At the very minimum, sales qualified leads (SQL) assigned to sales reps MUST be hearing from sales weekly (use the average follow up attempts metric to help you filter this). If a contact is in the early stages of the sales process, they should be hearing from you weekly – naturally balance this off with not being annoying.

Demo Time

Are your pre-sales teams running convincing demos that grasp prospect interest to continue the conversation? At the core, this is the average amount of time sales reps spend on demos, per account.

- Why you care: understand the relationship between demo time and closed-won or closed-lost deals. Most B2B businesses rely on a demo of some sort, from CRM software presentations, server rack installs, accounting software to armored trucks, demos capture attention & emotional buy-in…when done right.

- Sanity check: you need to know your baseline demo times for closed-won deals, this way, any deviation above or below should signal you to investigate what contributes to a high or low demo time.

- The formula:

- Baseline demo time = total demos made per closed-won clients / # of closed clients

- All demo time = total demo time for all leads / # of all leads that were demoed

2. Prospecting Intelligence

Prospecting is the heart of B2B business growth, since this is how you search for and attract potential clients. Realistically, few businesses have their prospecting game honed out, typically relying on personal relationships, referrals and acquired reputation to keep them humming. But what happens when your top sales people leave for other ventures, and you’re stuck without smart prospecting practices?

These KPIs aim to answer the following questions:

- Are your sales reps armed with enough product knowledge to sell? And,

- Do they have the critical thinking skills to go after the right people to avoid wasting time?

New leads / Sales Opportunity Generation

Which reps are reaching their new business generation quotas? No matter the sales team type (inside vs outside) your sales reps should have set quotas in generating new leads (vs waiting around to be assigned a lead)

- Why you care: as important as it is for your sales team to be hitting their calling, email and meeting quotas, it really doesn’t matter if no one is responding positively to their outreach attempts. Typically

- Sanity check:

- Are the right prospects being approached?

- Is the sales pitch relevant & effective in relation to the service/product being sold?

- Dashboard: Leadboard by sales reps & open opportunities

Number of Follow Up Meetings / demos booked

Are you sales reps’ pitch engaging enough to get meetings booked with the prospect? This is different from follow up attempts (mentioned above) which essentially measures persistence.

- Why you care: if your sales reps are having a hard time to get a meeting booked (either on the phone or in person) with a lead, it’s time to review the lead quality AND your sales rep’s sales approach – are they communicating value to the prospect?

- Sanity Check: If a sales rep has a healthy amount of meetings but doesn’t close, they need a boost in qualification skill or understanding of how to nurture a deal to close. If a sales rep barely gets prospects to meet, their value proposition and overall sales approach needs to be tuned.

- Formula/Dashboard: tracked on a monthly basis, shown as a dashboard ratio, ex: 10:2, meaning for every 10 SQLs, 2 2 have a follow-up meeting. Also can be shown on a simple leaderboard which tracks leads by sales rep and the associated follow ups per lead.

Deals on the Board

Do your sales reps know how to determine deals that are about to close? Or are they misunderstanding the deal stages & buying process of the customer – thinking that any lead that saw a demo is at 50% way to close?

- Sanity Check: ensure the team is clear between definitions of lead, sales qualified lead and opportunity. Moreover, once your leads get to the opportunity stage, ensure you deal stages reflect the buyers buying process, has a proposal been made or a contract sent?

- Formula/Dashboard: look at all active opportunities and their percentages, why is one in the 25% while the other is in 80% deal stage range?

Churn by rep

Are you signing bad customers that end-up leaving in the short term? And, are your sales people developing long term relationships? Most growing sales teams are training to close, close, close, and when they do, they throw the customer to the execution team (we’re all guilty of this one). This typically leads to misaligned expectations, poor onboarding, lack of funding, and lack of leadership for the new customer.

- Sanity Check:

-

- Prospect better: ensure your sales reps know your product and know the ideal customer personas, this way, they’ll be prospecting with the right from the start.

- Qualify better: Good customers don’t churn. But in order to close a good customer, they need to be qualified & sold to with their end-success in mind, deal don’t end at the signature of the paper, especially in B2B software & technology organizations.

- Churn hurts growth: if this isn’t obvious enough, B2B sales cycles are long, which means a lot of time is invested into acquiring a customer. Retaining a customer is always less expensive than losing one.

- Dashboards to set up:

- Churn by sales rep: a monthly bar/line graph, typically measured as a percentage, by rep, over a period of 12 months.

- Churn by reason: why did the signed customer leave? Top reasons for churn are:

-

- Lack of adoption

- Lack of internal champion

- Poor budget planning

- Too many customizations / lack of features

- Competition

-

-

- Formula: Annual Churn Rate = uses lost this year / users at start of years + users added this year

Email Open Rates

Do you sales reps know how to write engaging, value-added emails that get opened? Your sales reps must know how to write non-generic and personalized first touch emails, even if the emails are templated.

- Sanity Check: professional & persuasive email writing is an art-form, thankfully it can be taught. There’s a myriad of sources online you can read about writing effective emails, catchy subject lines that offer value to the prospect. Your marketing team has experience with this, ensure the sales team works with marketing to draft pre-canned personalization capable emails that can be tracked.

- Dashboards to set up: all emails sent by sales rep vs all emails opened

Brand Mentions

Which brand keys are being mentioned on the web that should trigger sales prospecting? Let me make this more simple as this is an advanced metric to track, here are the top scenarios I track in my CRM.

- Sanity Check: You’ll need to work with marketing to set it up active listening triggers based on search intentions, applied to specific media channels.

- Someone mentions your brand

- Someone asks a question about your service type

- Someone asks a question about a competitor service/product

- Someone uses a competitive product for xx years (referred to as Technographic search)

- Dashboard: Active listening UI, some CRMs have it within their social integrations, otherwise you’ll have to look for a tech app provider to set this up.

3. Performance Indicators

Sales performance indicators reveal improvement areas in skill and process development. You might have high performing reps that close deals well but have a hard time prospecting, conversely, you might have amazing prospectors that know how to spark a conversation, but do not have the skills to nurture and close the deal. There are also sales process considerations such as whether or not your qualification is too light or tough. In any case, performance indicators point out the highs and lows of the team to help you optimize to close more.

Lead-to-close rate & ratio

How many leads do you need, in order to convert them to paying customers? Knowing the average amount of leads that become paying customers along with your sales cycle duration will enable you to understand the following; what you need to do to keep current sales at a stable rate and what actions to take in order to increase closed deals.

- Sanity Check: a low lead-conversion ratio usually means your sales pipeline needs improvement.

- Formula: lead conversion rate = (# of closed leads for a period of time / # of new leads for a period of time) x 100

Opportunity Win / Close Rate

How effective is your sales team in the final stages of the sales funnel? Win rate is the number of closed-won opportunities (also known as close rate). In order to help your team close more, you’ll have to determine in which stage they are having issues converting.

- Sanity Check: Win rates are typically low due to a lack of; robust qualification tactics, product knowledge and/or demonstration ability. Always analyze win rates in combination with metrics like deal size or referral channel, as that may also be a good indicator as to WHY the win rate is what it is.

- Formula: Win rate = (Closed-Won Opportunities in a timeframe) / (Total Closed-Won + Closed-Lost Opportunities in that time frame).

Percentage of team hitting their quotas

Are your sales quotas realistic, or did you build a castle in the sky? If the majority of your team is hitting their quotas…say above 65%, then you can say the goals you’ve set are realistic.

- Sanity Check:

-

- Too high: if everyone is a rockstar, hitting over 85% of quota, that means you’ve probably set the bar too low (I know pessimistic…alternatively…you’ve found a unicorn sales team)

- Too low: if the team is struggling to hit quota and are barely making 45% of it, you’re being unrealistic with your demand…or you’ve hired a junior team that needs some educational nurturing to sell your service/product.

- Dashboard: set the sales quotas, by sales rep and category and see the bar chart or speedometer get closer to the goal, most CRMs have this as a stock feature.

Average time to lose

How can you disqualify leads earlier on in the sales process? Stay focused on what matters, qualified leads that have real potential to convert. Most salse teams do not measure time to lose, and they’re missing out on a valuable metric.

- Sanity Check: average time to lose can identify leads that have:

- Not been updated in the CRM (essential skewing your forecasting)

- Not been qualified correctly, which means there’s an opportunity for coaching

Sales volume by location & channel

Which territory/channel is visibly killing it with sales? Every business has a tendency to sell more in a certain location. Whether it be because of sales rep distribution, higher service demand, or focus you’ve put on selling to that specific market. As you grow, understanding your locations -and their sub-cultural nuances- will help you adapt & customize your product/service to resonate even more with the performing location.

- Why you care: know where to spend your marketing budget & sales efforts.

- Sanity check: if a location is a high converter, ensure to check against the deal size, complexity and sales cycle duration

- Dashboard: a basic dynamic list of all of your closed-won sales filtered by location origin.

4. Conversion / Pipeline Indicators

Is your sales team effective at guiding prospects through the sales process? Conversion KPIs measure the quality and effectiveness of sales activities, typically measured as a percentages.

Conversion KPIs are great pipeline indiators, simply because they show you the flow of prospects from initiation through to close (dare I say…down the funnel). This allows you to hone in on fixing your sales process by stage.

Cautionary note: for all conversion rates we’re gonna cover below, keep in mind that longer sales cycles will require relevant data. So, for most B2B businesses, you cannot compare conversions in a one month span, you should be focusing on quarter, half year and yearly increments.

Lead to MQL Conversion Rate

Is the marketing team qualification criteria aligned for basic sales handoff? The lead-to-MQL is the percentage of leads that the marketing team determined are more likely to become customers.

- Why you care: the less leads that get to MQL, even less will make it to the SQL stage.

- Formula: # of MQL leads / # of total leads

MQL to SQL Conversion Rate

Is the marketing team nurturing the right people? MQL to SQL conversion rate is the percentage of marketing qualified leads that convert to sales qualified leads.

- Why you care: you need to keep the sales team busy with relevant leads. Typically by analyzing this conversion rate and digging deeper into itm you’ll find that various teams have misalignment between what constitutes a lead. This will help you refine sales & marketing processes and close the distrust gap between the two teams.

- Pro Tip: use predictive lead scoring to help assign leads that are ready for sales contact.

- Formula: MQL to SQL Conversion Rate % = #of SQL / # of MQL

SQL to Demo Conversion Rate

Are your sales executives convincing enough to book a demo? At this critical step, your sales reps must ask additional questions (to prep a solution overview for the demo) and provide the relevant material to the prospect to show them that you’re the business to work with.

- Why you care: If your reps are burning through valid SQLs without booking demos, either the SQLs are not qualified correctly or the pitch isn’t enticing enough.

- Formula: SQL to Demo conversion rate = # of Demos / # of SQLs

Demo to Proposal Conversion Rate

Can your sales executives convince the prospect to review, or better yet ask for a proposal? Sending a proposal in B2B businesses usually triggers a 50% to 60% likelihood that the opportunity will be won, it’s imperative to ensure that your demo makes the prospect want to buy.

- Why you care: improve your qualification and demo practices, catered around what the client actually wants to see. Focus on solving a client problem vs showing a system/product overview without targeting the needs stated in the initial few calls you’ve had.

- Formula: Demo to Proposal Conversion Rate = #of Proposals / # of Demos

Proposal to Close Conversion Rate

Does your sales team have the skill to understand and involve themselves in the buying process of the customer? Since B2B purchasing decisions are made on a committee level, your proposals MUST address the needs, concerns & questions of all of the decision makers & their influencers.

- Why you care: if an opportunity got to this point, you almost have it…or you’ve totally misread the customer. Ensure the team uses standardized templates that are then molded to customer requirements spec.

- Formula: Proposal to close conversion rate = # of closed opportunities with proposals / proposals sent

Cross-Sell Rates

How can you effectively increase revenue with what you’ve already got? Cross-selling is when you sell a related product/service to an existing customer base. This helps you keep your technology partners happy and makes your brand into a one-stop-shop. Also, a happy technology partner that sees you cross selling their product is more likely to recommend your services 😉

- Why you care: increase customer loyalty, build on partnerships, extend your sales capacity and expand brand reach.

- Sanity check: are there complimentary products you can be selling that are mutually beneficial? How often do opportunities arise to sell complimentary products?

- Formula: cross sell rate = # of total cross-sold services / # of qualified cross-sell clients

5. Forecast Indicators

Accurately forecasting your sales pipeline is critical for overall organization growth. Do you have enough stable data to set sales baselines and forecast future growth?

Sales Cycle Length

How do you shorten the sales cycle? This is the time it takes to close a deal, from initiation to completion. Typically, the less time a lead spends in a certain stage of the cycle, the better it is.

- Why you care: Critical to forecasting your revenue based on past sales cycle time to close. Great for managing internal and client expectations and being able to time sales activity against the buyer’s journey. Also allows you to coach sales reps that are not moving prospects fast enough through the cycle.

- Sanity check: start by analyzing how much time leads spend in every stage of the cycle. This way you’ll know which stages to optimize (if possible) in order to reduce the overall length of the sales cycle. Most CRMs have this dashboard as a standard feature, you just need to ensure you setup your deal stages correctly.

- Formula: Average Sales Cycle Length = # of days to close deals a,b,c,d / total number of deals (4 in this case) deals

Average Deal Size

Understanding your average deal size will let you forecast your revenue ahead of time, it will also let you have a baseline, a deviation from which may indicate a red-flag.

- Sanity Check: If your average deal size is 55K and one of your reps spots a 125K, it should be marked as at-risk, simply because a bigger deal typically means a longer sales cycle, hence more resource expenditure and risk of losing it. But, that may not always be the case, if your company is growing and adding new services, larger or smaller deal-sizes simply mean you might be evolving, always dive into the data to understand how to act on it 🙂

- Formula: Average Deal Size = # dollar value of closed-won deals in 12 months / total # of closed-won deals in the past 12moths.

Sales Pipeline Velocity

How effective is your sales team at moving prospects through the sales cycle? Pipeline velocity is the speed by which leads move through your sales pipeline. is one of the most important sales KPIs to track since it touches on how your sales reps prospect, demo and nurture the prospect to close them.

- Why you care: the longer it takes to close a deal, the more of a chance you have of losing it

- Sanity check: Establish a baseline for your business, strong fluctuations in pipeline velocity will lead you to look into win rates, deal sizes and prospecting practices, all of which affect velocity. For short deal cycle companies, velocity may be measured monthly, for B2B firms where 4 weeks just isn’t enough to close a deal, measure velocity by quarter.

- The formula: pipeline velocity = (# of opportunities x Deal Value x Win Rate) / Length of Sales Cycle

Revenue by Lead Source / Channel

Which source of new or recurring work provides the most revenue? This can be partnerships, social channels, current clients, ad listing sites or eCommerce platforms. Also a crucial KPI to track as without knowing your revenue channels, you’re not able to nurture them, this is equivalent to throwing money out.

- Why you care: Hone in on your prospecting approach by understanding which lead source to invest time & budget into.

- Sanity check: Ensure your sales reps & marketing team track the origin of closed-won leads.

- The formula: you can track this via a simple leaderboard style dashboard or a smart/dynamic grid view list.

Average Profit Margin

Which of your services are the most profitable for the company? Average profit margin measures the average profit made from the sale of a specific service or service category. Understanding your top performing product/services will allow you to optimize your sales process to focus on selling for profitability.

- Why you care: understand the most profitable services you should be focusing on optimizing for growth or dropping.

- Sanity check: Just because a service may be higher profit than others, it doesn’t mean the business focus should switch to it, verify if you have the processes, technology, partners and manpower to support reprioritization of higher profit services. For example, if your business does x3 sales per year that are from the high profit category, but the whole business is structured around another service/product that has x25 sales, it would be unwise to rejig the whole company for a risky potential x3 sales.

- The formula:

- Profit margin = ((sales price of service – cost of service) / (sales price of service)) x 100

- Average profit margin = (profit margin of a, b, c, service) / (# of services) x 100

Average Cost Per Lead (CPL)

How much is it costing you to acquire a lead? Average cost per lead measures the cost-effectiveness of your marketing campaigns, whether they are inbound or outbound. Understanding your baseline CPL will allow you allocate the right budget for the right campaign to potentially increase sales.

- Sanity Check: knowing the cost of your inbound and outbound leads is critical for forecasting your sales growth, given that your sales process works.

- Formula: Average cost per lead = total $ spent on a campaign / total leads generated

6. Customer Indicators

Evangelist Score / Net Promoter Score

How likely are your current clients to recommend you? The evangelist score is the score given to customers and partners on the likelihood of recommending you. Also referred to as the Net Promoter Score (NPS).

- Why you care: at the core of it, the NPS evaluates customer loyalty, the more loyal a customer is, the more they’ll buy from you and recommend you to their colleagues. Having a low average score usually indicates a problem within the execution & project management teams.

- Sanity check: Send the survey once every 6 months, and ensure that you have a custom field in your CRM to capture the below score ranges.

- Evangelists (9-10): also known as Promoters, they love you, interact with you, show up to your events and are more than happy to recommend you to others. Always understand what and who built a relationship this way and try to replicate that for future clients.

- Apathetic (7-8): also called Passives, these clients need immediate warm-fuzzy relations, or you risk losing them to competition, as they are ripe for picking.

- Toxic (0-6): also called detractors, these are clients that will not be renewing contracts with you, or are actively pursuing leaving you. Typically they will also leave negative reviews or bad-mouth you to colleagues.

- The formula: Net promoter score = % of Evangelists – % of Toxic

Client retention

Recurring revenue is sweet, it also accounts for over 60% of your company’s business. According to Harvard Business Review, gaining new customers is between 5 to 15x more expensive than keeping a current one, bootstrap your account management team skill set.

- Why you care: Everyone knows that upselling or cross-selling to existing clients is much easier than gaining new ones, so ensure you keep them happy. Losing clients isn’t fun. Losing pissed-off clients that then tell everyone how terrible you are, is…less-fun, disastrous for both your client & partner reputation.

- Sanity check:

- Customer touches: maybe the sales team simply didn’t show love, swing by your system touches KPI we discussed above and verify if the touches are extremely low (usually, the lack of communication is a massive contributor to customer attrition)

- Reasons for leaving: know why your clients leave you (NPS helps with this) and quickly fix any low hanging process or execution issues.

7. Marketing to Sales Handoff Indicators

Why forgotten? Because after speaking with a couple of sales leaders, they’ve neglected to mention them – yet high growth companies include them as part of their regular routine.

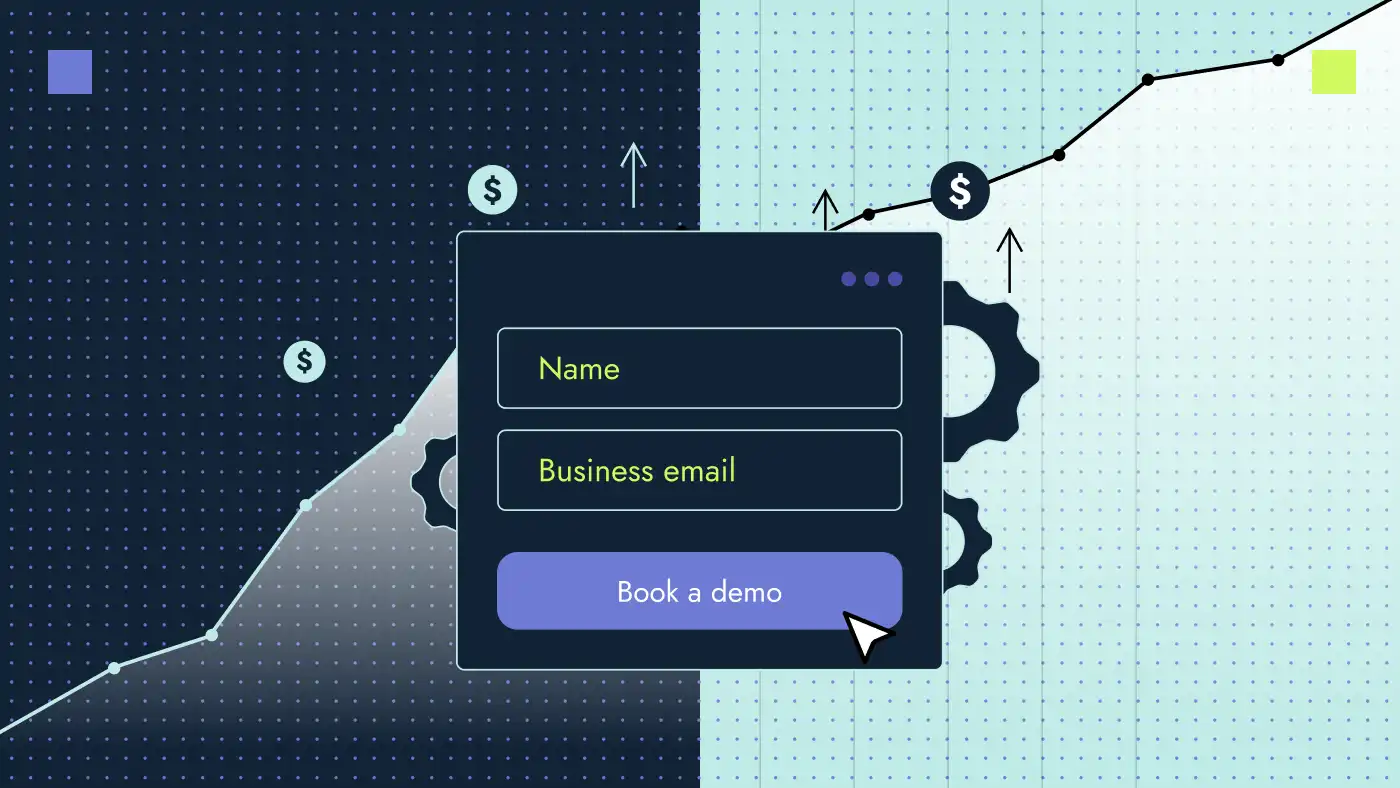

Visitor-to-Lead Conversion Rate

Is your marketing team attracting relevant audiences (quality traffic)? Mistrust between marketing & sales is rampant, both blaming each other for incompetence when it comes to either providing bad leads or not being able to close a sale. So how do you know if the team is attracting good-enough leads so that a solid sales exec can work on converting them?

- Why you care: An irrelevant audience (from territory you do not cover, or simply the wrong demographic and malicious bots finding your site) contributing to high bounce rates, and frustrated demand-gen teams.

- Sanity check: Run a content marketing audit, ensure your seo strategy is sound and that the right sales people get the right type of leads assigned to them. As a rule of thumb, the higher your conversion rate, the happier the sales boss will be 😉

- Formula: visitor-to-lead conversion rate = (#of visitors that became leads for a period of time / total number of visitors for a period of time) x 100

Competitor Pricing

Knowing your competition and staying a step ahead of them is always healthy for your sales teams’ negotiation tactics. Competitor pricing is easy to find out, as the process to find out the prices also reveals their approach to prospect nurturing.

- What it is: Know your competitor pricing to know if you can do a price-match policy.

- Why you care: Train your sales team to know how to handle pricing objections & display market intelligence to the prospect.

- Sanity check:

- Discounting: I never discount, as discounting shows that you haven’t put your best foot forward from the beginning, or haven’t qualified the lead correctly. But, showing how much more value you offer for the money, is always a better way to deal.

Sales team satisfaction

Ready for this one? All of the above KPIs go to sh!t if your sales team isn’t motivated & happy. But that’s a post in itself we’ll tackle together soon. No this isn’t some HR guide, we don’t know the last time HR had a meaningful impact on…anything.

8. Goal Setting

Every KPI must tie back to a goal, I’m not going to preach the importance of goal setting for company growth, because that’s too basic for you. Instead, here’s a high level sample table. You should be using to tie KPIs to the goals they are enriching. Naturally you should have more sales goals and your KPIs should be grouped in clusters.

| KPIs | Goals | |||

|---|---|---|---|---|

| Increase # Leads | Increase Nurturing Quality | Increase Sales | Increase Influence | |

| Follow up attempts | X | |||

| New Leads | X | |||

| System Touches | X | |||

| SQL to Demo Conversion | X | X | ||

| Demo to Proposal Conversion | X | |||

| % of team hitting quota | X | X | X | |

| Churn Rate | X | X | ||

| Revenue by Lead Source | X | X | ||

| Sales Cycle Length | X | X | ||

Questions to ask to ensure your goals are smart

- What are my business goals for xxx to xxx period?

- What KPIs am I currently tracking that do not tie to a goal?

- Are more goals attainable? What business or industry baseline can I use in order to ensure my sales team can reach the goals?

- Do we have accurate data needed to monitor the KPIs? This is also one of the biggest reasons that emerging and early-middle market companies do not take KPIs seriously…their data & internal processes are not clean.

- Who is going to use the KPI report and what do they need to know?

- How am I going to visualize specific KPIs (dashboards, graphs, etc.)?

Learn more, sell better

- Learn why knowing your personas helps you grow leads & sell better

- Soul-crushing reasons on why your email marketing probably sucks

- Using sales & marketing automation software helps grow sales by at least 10%