The competitive nature of today’s business world rewards the master of B2B competitive intelligence.

If you have an in-depth idea of what your B2B competitors are planning for their businesses, you can use this knowledge to stay one step ahead. But you’ll have to pay close attention to the tiniest detail, from their website content to their customer reviews and social hashtags, to name a few. All of this information and insight is needed to run a competitive intelligence project.

But what exactly is B2B competitive intelligence, and how can you ethically gain information on your competitors to counteract their plans?

If you’re still in the dark about competitive analysis and how to properly implement its practices, don’t worry. In this article, we’ve got you covered.

What is competitive intelligence?

Competitive intelligence is the process of gathering and analyzing information about your competitors, their customer interactions and market trends to make informed strategic decisions.

Also known as corporate intelligence, it aims to identify gaps and opportunities in your business environment.

This strategy isn’t merely about learning your competitor’s weakness or figuring out ways to undermine others in your industry. Instead, the goal is to gather information to gain a tactical and strategic business advantage that will benefit your company in the long run. According to Salesforce, competitive intelligence can help you quickly identify opportunities, understand your competitors and leverage data intelligence to capture potential customers.

Download now: Competitive matrix for SaaS teams

Why competitive intelligence is necessary

Almost 90% of Fortune 500 companies already use competitive intelligence to gain an advantage, according to Emerald. Understanding other brands’ motivations and strategies helps your business perform even better in your industry.

Building a business without competitive intelligence is like building a brand without a sense of direction. While you can always develop strategies independent of your opponents, it’s easier to tell whether or not you’re going in the right direction when you judge it against your B2B competition.

Here are a few reasons why B2B competitive intelligence is essential:

Monitor trends

The market is constantly changing with new trends and technological advancements. You need to monitor and track trends or risk getting left behind in the battle for relevance and technological supremacy in your industry.

Monitor your B2B competition

It’s risky to try to build a brand based on assumptions. Fortunately, B2B market intelligence helps you review other brands and determine how they stay ahead of the game.

More importantly, competitor intelligence helps make informed predictions about the next steps of your competitors to a very high degree of accuracy. By gathering and monitoring the data and insights on your competitors, you’ll have a proper understanding of their plans and the next steps they may take to reach their goals in the short term.

Optimize your marketing strategy

Competitive intelligence helps you to review and retouch your marketing strategy in the light of instructional data and information. Markets constantly evolve, and staying informed about competitor activities helps you adapt quickly and outperform them.

Corporate intelligence also helps you create a marketing strategy that reflects real-life conditions rather than just theoretical assumptions. You’ll find this valuable whether you want to make more sales or launch a new product or service.

Understand your customer’s needs

There’s no better way to learn how to (or how not to) serve your customer base than by watching others do it. The go-to strategy to characterize your customers is to draw up a buyer persona based on what you think they like and their likely habits.

You can also get to know your true customers based on your understanding of how they perceive other brands that sell the same products or services you’re offering. You’ll get to know what they value, what they look for when they’re searching for your services, the factors that influence them and how to ensure your product offering is resonating.

Discovering the factors that cause customer dissatisfaction with your competitor’s products or services presents an opportunity to improve your own products.

Redefine your business direction

With inspiration and insights from your competitors, you’ll better understand how to run your brand and get to think out of the box.

Note that this is not about copying what your competitor is doing. Rather, you get to modify your own trajectory based on your competitor’s journey. For instance, imagine your competitor recently introduced a pricing review that negatively impacted their bottom line.

By evaluating what they did wrong, you can decide whether or not you can implement the same pricing review or if doing so would yield desired results. You may also discover a whole new direction for your pricing policy review that puts you at a direct advantage.

Sources of B2B competitive intelligence

Fortunately, the competitive research market is flooded with numerous tools for gathering information and analyzing data to learn more about your competitors. But where exactly will this data come from?

You begin gathering competitive intelligence for your business by monitoring competitors’ output of blogs, ads, social messages, whitepapers, videos etc. However, perhaps the best way to understand them is to find out what consumers like about a brand or a product through reviews. This information-gathering can help you know what your B2B competitors are doing.

Here are different sources of B2B competitive intelligence:

Social media platforms

Monitoring the reviews on your competitors and tracking their social media profiles can help you understand what trends are going on, what events they are participating in and how your brand can get in on these trends.

Reviews about your competitors on social media can help you understand how best to serve your customers and how you can improve your product or services. This will, in turn, help you create the best product strategy.

Another thing to monitor is the type of employees your competitors hire, their roles, their employee growth rate, what content they publish, what hashtags they use and so on.

Let’s look at LinkedIn as it has become a professional hub. Businesses often share professional posts with new insights to educate their followers. You can view your competitor’s LinkedIn page to get an idea of what they’re doing right and incorporate this into your business.

Competitor websites

By closely studying your competitors’ websites, you, too, can gather information on how they run their organizations. Asides from having an estimated view of how they generate sales or the products or services they offer, you can also get information on how they plan their product or brand strategies. Monitoring your competitor’s websites will help you get first-hand information on press releases, partnerships etc.

Syndicated research reports

Marketing tests

You can avoid the stress of setting up your own tests by gathering insights from campaign tests set up by competitors. This is a good way to learn everything from what you need to implement for your own tests to creating detailed strategy documents based on tested insights.

Pricing and packaging updates

Changes in positioning and messaging

Aside from examining the beauty and creativity of these new changes, you can also watch out for how the market responds to them.

How to conduct competitive intelligence research

According to Harvard Business Review, the actual goal of competitive intelligence isn’t just to collect information on competitors but also to make plans that will benefit your business.

This section explains how competitive intelligence works and how to conduct the research effectively.

-

Track your direct and indirect competitors

- Your direct competitors are brands offering the same products or services as you. They’re direct alternatives that your target audience can consider to meet their needs.

- Your indirect competitors are businesses that do not offer the same products and services as you do, but their products can still satisfy your customer’s needs.

After this step is complete, you can start working on a comprehensive strategy to carry out in-depth research on them.

-

Build a relationship with your tertiary B2B competitors

For example, if you sell software that helps sort out sales commission rates, your tertiary competitor would be a business that sells software that helps manage the entire sales cycle or a sales team. Both businesses have the same target audiences (sales managers or quality assurance specialists) but offer different products.

It is possible to get inspiration from tertiary competitors on how to stand out amongst your rivals. While doing so, be alert because they may become your primary or secondary competitors if they decide to pivot into your industry or offer similar products/services as you do.

-

Gather insights and data on your competitors

Take note of the products and services your B2B competitors offer and why they offer them. You must determine your own “Why” to decide on your next steps.

Once you know the insights and information you want from your competitors, the next step is to go for data that helps you gain these insights. You have different sources of data that you can check out (listed below), which will give you more information and insights into your competitors and their services.

By looking through their websites and blogs, you can identify what services they offer and what content they post. Take a look at their audience’s reviews and feedback, and take a look at yours, too.

Type of data to gather:

- Product offerings: How are the competitors’ products and their products’ pages different than yours? Do they have more features or use case pages? Are there any subtle differences that your client does not know? These questions and the data gathering it leads to are important for a B2B competitive intelligence project.

- Pricing: Pricing research is important because it provides valuable feedback and suggestions for your product pages, as well as strategies to frame your competitive blog posts (that go head-to-head with other competitors comparing features and products etc.)

- Partnerships: What partnerships does your competitor have? You can get this data by going to their integration pages or asking questions. This step can help you find valuable partners for your business as well.

- Company priorities (what are they writing about/developing?): Understanding the priorities of competitors helps you make strategic decisions related to market entry, product development and resource allocation. Recognizing these priorities also allows you to identify market trends or untapped opportunities.

- The kind of marketing they use: All your competitors’ marketing departments will be run by different people with different ideas on how to approach marketing; therefore, all their strategies will be different. Is there anything that is working better for one or more competitors? Did someone hit the mark better? You need to bring these tactics to your company and see if they work well for you.

- Content strategy: This refers to understanding how the content the competitors are writing differs from your own. In SEO, this will show as a keyword gap for the keywords not part of your existing content strategy and inform you quite quickly of their strategy. What you discover can help you decide what to do with content moving forward.

- Level of engagement: Based on their website UX, you can have a mental idea about how much engagement their content generates. This will inform your own UX strategy. Is their website easier to use? Would I spend more time on this website going through more pages? The competitor may have more engagement if this is a more positive “Yes” than your own website.

- Social media presence: Social media strategies are important and will stay relevant because they significantly contribute to customer retention. Your loyal customers follow your socials and wait for good deals and product updates. If your competitors are doing this better, you need to incorporate this into your own social strategy and not miss out on those customers.

- Industry reports and analysis: Industry reports from research firms such as Gartner, Forrester or IDC can provide useful information on market trends, growth projections, and the competitive landscape. These reports are often available for purchase, but some may be accessible for free through public libraries or online databases.

-

Build a competitive intelligence model

To build a B2B competitive intelligence model, marketing teams should follow specific steps to ensure the model is customized and effective.

- Identify the specific areas of the business that require analysis, such as marketing, product development or sales.

- Determine the data sources for each area, including competitor websites, social media and industry reports.

- After gathering the data, your team should organize it in a structured format that allows easy analysis using spreadsheets or databases.

- Next, apply analytical tools such as SWOT analysis or Porter’s Five Forces to the data to gain insights into the competitive landscape. Finally, use the insights gained from the analysis to inform strategic decision-making and action planning.

-

Communicate with your stakeholders

B2B competitive intelligence research methods

Michael E. Porter created Porter’s Five Forces to help companies conduct competitive intelligence research and measure the market’s competitiveness. According to him, five main forces can help you with your analysis:

- Consider the number of competing brands and their ability to undercut your company.

- Understand the potential of new brands entering your industry.

- Count the number of brands supplying the industry and how much power they have to influence the cost of inputs.

- Determine if replacing your company’s products and services will be easy.

- Know the power of your customers. Generally, the fewer consumers, the more power they wield.

1. Tracking content gaps, changes and updates

Content analysis can hint at your competitors’ buyer personas. If you notice a slight change to the content of your competitor, they may be speaking to a new set of buyers. This may have far-reaching consequences for your own business. For instance, their new audience may represent a class of customers you should have always paid attention to.

👉 Read this competitor content gap analysis guide for an in-depth understanding of finding content development opportunities in organic search.

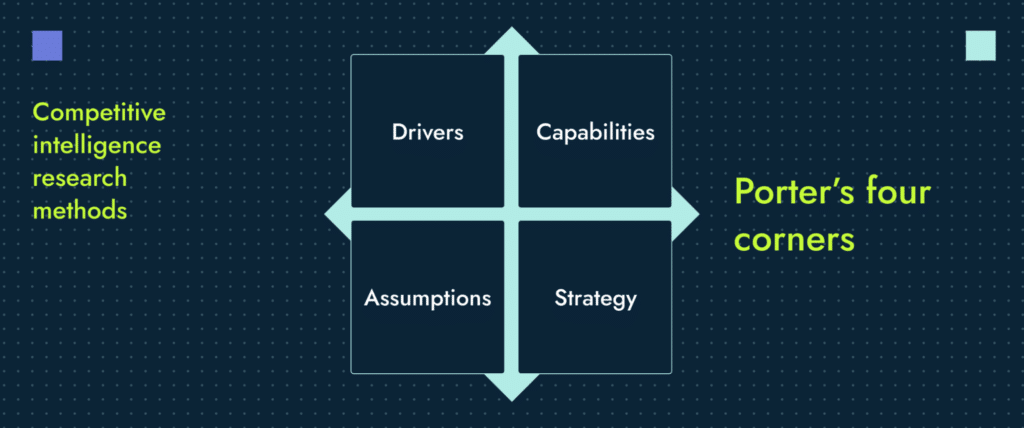

2. Porter’s four corners

Motivations

Two important factors are your competitor’s “drivers” and “management assumptions.”

- The drivers refer to your competitors’ goals, strategies, leadership background, corporate culture or values. These are the factors that power decision-making and the overall structure of the organization.

- The management assumptions refer to your competitors’ inherent beliefs about their weaknesses, strengths, market positioning and other similar factors. These assumptions unconsciously fuel decision-making in any organization.

Actions

Here, the two main things to look at are the “strategies” and “capabilities” of your competitor.

- The strategy refers to the alignment between your competitors’ goals and their actions within the industry.

- Capabilities refer to the strengths, resources and partnerships that improve the effectiveness of their strategy execution.

Identifying gaps in this area may provide possible areas for your companies to explore to gain a competitive advantage.

3. SWOT / TOWS analysis

This strategy aims to determine your brand’s opportunities and strengths in your industry by comparing them with your competitors’ strengths and weaknesses. For instance, a company contemplating diversifying its product offerings to include new high-end products may do a SWOT analysis to determine its viability. The analysis may reveal that the company is the market leader for its existing product line (strength), and there’s indeed an opportunity to expand into the newly identified market.

However, analyzing external factors such as material costs and distribution lines shows that it might need additional staff (weakness) and would face unpredictable demand (threat) if it goes ahead with the plan to launch the new products. If these weaknesses and threats outweigh the strengths and opportunities, the company may hold off on its plan for a few more months and revisit it with the hopes of favorable changes in the market.

4. PEST analysis

This analysis framework assesses your competitiveness in the marketplace based on external factors. Various modifications of this research method exist based on the introduction of additional factors such as legal, environmental and ethical.

5. Customer reviews

Reading customer reviews puts you in the know about what they like and what they don’t about your competitor’s services. You can use this information to your advantage by understanding what users like and dislike about the currently available software.

Competitive intelligence tools to help with your research

Are you ready to begin competitive intelligence research? The following tools will help you to conduct effective B2B market research. They will also help you understand how to keep your business thinking on its feet even in a competitive environment.

Buzzsumo

Buzzsumo also provides tools to monitor your competition and performance in real time. It helps you answer important questions about your competitor’s content strategy, including what types of content work best for them, what channels are the most effective and who is engaging with their content.

With Buzzsumo, you can create alerts that track when your brand name or specific keywords related to your brand or industry are mentioned. It is also an efficient tool to monitor influencers within your industry and identify collaboration opportunities.

Kompyte

Kompyte has a web-tracking tool that automatically tracks and captures changes made to competitor websites. This is a convenient way to monitor new features, product updates, pricing changes and promotions. Kompyte also has search marketing and social monitoring features to optimize your campaigns. In addition to setting up instant alerts to track these changes, Kompyte also provides an intuitive dashboard to bring all your data together, organize them effectively and analyze them for quick actionable insights.

Semrush

This tool has features to help supercharge your SEO efforts by auditing your pages, blog and docs center compared to your competitors. With Semrush, you can also monitor your competitors’ metrics for their websites and landing pages.

Talkwalker

Talkwalker offers AI-powered trends detection and analysis as well as social listening and social content rating features. As a social listening tool, Talkwalker can help you track your competitor’s activities and gather data across 10 social networks and up to 150 million websites.

It allows you to monitor their keywords, mentions and the people they are addressing with those keywords.

Talkwalker’s alert features can help you stay on top of your competitor’s digital activities. You can also set up alerts on trendy topics to stay updated with various customizable triggers.

Goals of competitor analysis

Short-term strategy

From helping you to gain insights about your competitors’ websites and blog content to how they send out newsletters, intelligence gathering helps you to understand better how to create effective short term strategies that add up to big results in the long run.

Types of short term insights you can gain:

- Keyword base gap: Identify the keywords that your competitors are using but you are not. This will help you to optimize your content and website for these keywords and improve your search engine rankings.

- Keyword topic cluster focus: Determine the topics your competitors are covering and the keywords they use to rank for those topics. This can help you identify gaps in your own content and develop a more comprehensive editorial calendar.

- Paid search focus: Analyze your competitors’ paid search campaigns to understand their targeting, messaging, and bidding strategies. This can help you optimize your paid search campaigns and improve their effectiveness.

- Critical landing pages: Identify the pages on your competitor’s websites that drive the most traffic and conversions to optimize your own landing pages and improve conversion rates.

- Traffic seasonality: Understand how your competitors’ website traffic varies over time to plan your own marketing campaigns and promotions to take advantage of peak traffic periods.

- Keyword growth trend: Track how the search volume for your competitors’ keywords changes over time. This can help you identify emerging trends and adjust your own strategy accordingly.

- Content output frequency: Analyze how frequently your competitors publish new content and their content types to develop a more effective content marketing strategy.

B2B market intelligence is there to provide guidance on how to compare your business’s strengths and weaknesses with your competitors and discover how you can be better by making immediate changes.

Long-term business strategy

Analyzing your B2B competition is useful for predictive decision-making. Using data-backed insights, you can predict how the market factors will change over time, how your competitor is likely to respond to them and the different ways you can adjust your response to give you an edge.

Long-term marketing strategy enablers are:

- Content output budget spend: Determine how much your competitors spend on content creation and distribution to allocate your content marketing budget effectively.

- Paid search budget spend: Analyze your competitors’ paid search spending to understand their investment in this channel.

- PR spend: Understand how your competitors invest in public relations, including media relations, influencer outreach, and crisis management, to identify opportunities to differentiate your brand and build relationships with key stakeholders.

- Social spend: Analyze your competitors’ social media activity and advertising spending to identify the platforms and strategies that are most effective for engaging with your target audience.

- Web maintenance spend: Determine how much your competitors invest in website design, development and maintenance.

- Marketing team staffing plan: Analyze your competitors’ marketing team structure and staffing levels. This can help ensure your team is properly resourced and structured for success.

- Event attendance: Understand which industry events and conferences your competitors attend and their investment level in these activities to identify opportunities to network, build relationships and showcase your brand.

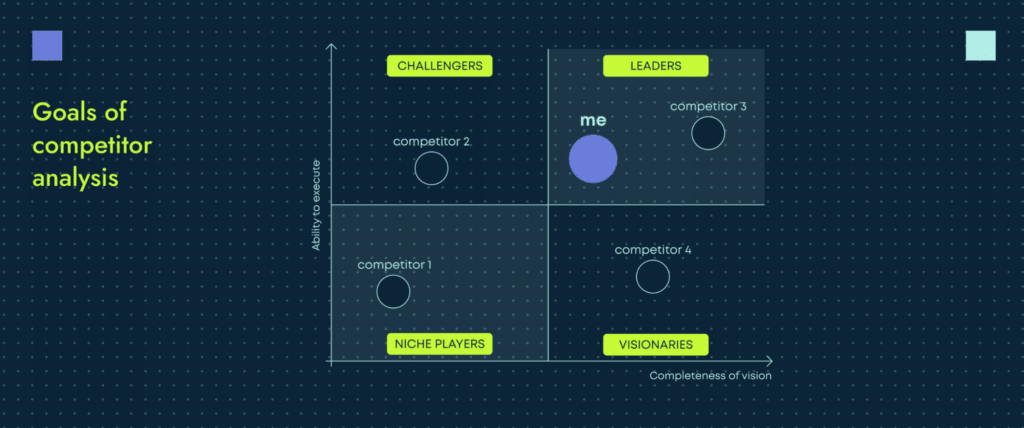

Improved market position

Examples of killer B2B alternative pages that help boost organic leads include:

- LearnWorlds: Kajabi Alternatives

- Keeper Security: Keeper vs LastPass

- Brinqa: Brinqa vs Kenna

One of the ultimate goals of gathering B2B intelligence is to help you find and leverage positioning opportunities in your market that you can leverage to stand out against competitors.

Once this has been identified, the marketing team can invest efforts into ensuring the right content is delivered to the customers based on the unique position you have taken up in the market.

✍️ Read our guide to discover why subject matter interviews are key to content marketing success.

Stay ahead of your B2B competition with Productive Shop

The end goal of every B2B go-to-market team is to increase market share via exposure and incrementally build a stable sales pipeline. Ensuring you’re keeping tabs on your B2B competition (especially when you’re a tech startup trying to break into a crowded market) enables you to maximize budget efficiency by helping you focus on what already works for others.

And let’s face it. Why shouldn’t you get an advantage over your direct competitors and be more confident when launching any new SaaS product? And if you’re doing anything well, you can bet your competitors are keeping their eyes on it.

At Productive Shop, we are no strangers to taking brands and startups to the top of their industry. We believe knowledge is power, and understanding your competition is key to success. Our dedicated industry consultants are here to help you unlock your brand’s full potential by offering tailored B2B competitive intelligence solutions designed to address your unique business needs.

Don’t let your competitors dictate your brand’s future. Schedule a consultation and give yourself the edge you need to thrive in the competitive B2B landscape.