Entrepreneurship is an exciting endeavor, filled with promises of innovation, disruption and perhaps, success. The climb is as exhilarating as it is daunting, but it demands resilience, determination and, above all, resources. Of these resources, one of the first and most critical that a young startup needs is seed funding.

Seed funding is the initial injection of capital that breathes life into a mere idea, enabling it to morph into a market-ready product or service. You can use it to cover anything you need, from office space and software licenses to salaries and marketing expenses. Seed money enables you to build a foundation for your startup, test your hypotheses and, hopefully, grow from there.

Yet, as necessary as it is, the process of raising seed funding is often shrouded in complexity, deterring the uninitiated and amplifying the doubts of those standing on the threshold of the entrepreneurial world.

As a roadmap through the twists and turns of seed fundraising, we’ve put together this guide covering key topics such as:

- What is seed fundraising, and why do you need it?

- Who to approach for funding?

- How to raise seed capital?

- How can you negotiate a term sheet and close the round?

- What happens after the seed stage?

What is seed funding?

Seed funding, also known as seed capital or seed money, is the initial investment raised by a startup to support its early-stage operations. As the name implies, it represents the “seed” from which a business is expected to grow. Seed funding for startups typically comes from various sources, such as crowdfunding, angel investors or venture capitalists (VCs) and private equity (PEs) firms specializing in early-stage investments. For tech startups, obtaining seed funding is often considered a significant early milestone and serves as industry validation of their concept and potential.

Seed funding is instrumental in helping startups weather the storms of their initial stages, where cash flow is typically limited and operational costs are high. In the first quarter of 2023, according to Crunchbase, the average U.S. seed round raised $3.6 million. This capital provides the runway a business needs to take off. Once the seed is planted and the startup begins to sprout, you progress to the following stages of funding — Series A, B, C and so on.

💰 If you need to brush up on the differences between seed funding and Series A before going further, we’ve got you covered.

Seed funding investors and sources

If you are ready to start raising capital, your first step will be identifying suitable sources of seed funding. Each type of seed investor or source brings different benefits and drawbacks, so understanding the options can help you target the most appropriate sources for your business.

Angel investors

Angels are wealthy individuals who provide capital for a business startup, usually in exchange for convertible debt or ownership equity. These investors can offer valuable mentorship, advice and industry connections in addition to funding. Among the top angel investors are:

- Naval Ravikant: The CEO and founder of AngelList has seen 60 exits, with noteworthy investments in Twitter, Uber and Stack Overflow.

- Mark Cuban: The billionaire entrepreneur and celebrity investor from Shark Tank is not afraid to take risks. His seed investments span various sectors, from technology to consumer products.

- Mike Maples Jr.: The co-founder of Floodgate, a venture capital firm, is renowned for his seed investing and has been involved in funding more than 50 startups, including Twitter and Twitch.

Venture capitalists (VCs)

VCs are professional groups that invest in startups and early-stage companies that have the potential for high growth. These firms typically offer large amounts of funding, expertise and networks. In return, they usually ask for equity in the company. Notable early-stage VCs include:

- Lightspeed Venture Partners: Known for its significant investment in tech unicorns like Snap, Lightspeed Venture Partners specializes in backing groundbreaking innovations and turning them into global brands.

- Aleph Venture Capital: This VC firm supports companies at their early stages, particularly in the technology sector. Their notable investments include the home improvement network Houzz and Lemonade Insurance.

- Unusual Ventures: A VC firm that focuses on early-stage investments, offering hands-on support to entrepreneurs. Their portfolio includes investments in Robinhood and Styra.

Private equity firms (PEs)

PEs generally invest in profitable mature companies. Still, they can occasionally invest in early-stage startups that demonstrate a robust business model and significant potential for success. PE firms typically invest large sums and hold a substantial stake in the company. Take a look at these key players in the PE space:

- Insight Partners: A multi-stage investor in high-growth software companies (scaleups), Insight Partners has backed successful ventures such as Monday.com and Shopify.

- Battery Ventures: Focusing on technology and innovation, Battery Ventures has invested in industries ranging from software to industrial technologies.

- Sequoia Capital: Known for its investment in Apple and Google at their early stages, Sequoia Capital has a proven track record of spotting tech giants.

- Next47: Backed by Siemens, Next47 focuses on transformative technology startups in artificial intelligence, autonomous machines and decentralized electrification.

Accelerators and incubators

These programs offer seed funding, mentorship, office space and other resources in exchange for equity. Prominent examples of startup accelerators include:

- Y Combinator: One of the most renowned accelerators in the world, Y Combinator programs provide seed funding for startups and offer intensive coaching over a three-month. Their portfolio includes Dropbox, Airbnb and Reddit.

- Techstars: With a global network, Techstars has mentored over 2,200 companies. Their alumni include SendGrid, Sphero and ClassPass.

- SOSV: This multi-stage venture capital investor runs multiple vertical accelerator programs, including HAX (hardware), IndieBio (life sciences) and Orbit Startups (startup scaling). SOSV’s portfolio boasts companies such as Upside Foods, Getaround and BitMEX.

Crowdfunding platforms

These channels allow startups to raise small amounts of money from a large number of people, usually through the internet. This approach can also help validate your product in the market. Crowdfunding has recently become increasingly popular, with many platforms offering services, including:

- Kickstarter: One of the better-known crowdfunding sites, Kickstarter allows entrepreneurs to raise money for creative projects and businesses. The platform works on an all-or-nothing funding model, where funds are only released if the campaign reaches its goal.

- Indiegogo: Unlike many crowdfunding platforms, Indiegogo welcomes campaigns from a diverse array of categories, such as tech, design, health, music, film and more. The platform offers flexible (receive funds as they come in) and fixed (all-or-nothing) funding options.

- StartEngine: StartEngine enables everyday people to invest in private companies. Investors can choose to provide funding for companies in exchange for a stake in the business, opening the door for non-accredited investors to fund early-stage startups. StartEngine made headlines in 2023 when it announced the acquisition of a fellow crowdfunding platform SeedInvest, bolstering its user base by 700K users.

Debt financing

This seed funding source involves borrowing money from a bank or credit union that you agree to pay back with interest. A business loan doesn’t require you to give up ownership in your company, as many equity financing options do, but it does require you to repay the loan amount with interest, regardless of your business’s success. Things to consider:

- Lenders often base their decisions on the borrower’s credit history. It’s beneficial to keep your credit score as high as possible.

- Speak with a financial advisor to help understand the terms and implications of the loan.

Bootstrapping

Bootstrapping refers to funding your startup through savings, cash flow from initial sales or other non-traditional methods that don’t involve external investors. This approach allows you to maintain complete control over your business but also means you bear all the risk yourself. Effective bootstrapping strategies include:

- Take a line of credit (you can easily get less than a 10% interest rate).

- Spread the risk among multiple partners you are starting with; everyone’s financial skin and sweat equity MUST be in the game.

- Avoid using your credit card unless you want to pay a 19%+ interest rate. However, do max out your allowed credit limits for emergency technology purchases.

How to build an investor list

An investor list is a carefully curated selection of potential seed investors who might be interested in financing your startup. This list not only guides your outreach efforts but also helps you build strategic relationships with the right partners. To build a comprehensive seed investor list, consider these strategies:

- Specialization. Check if a potential investor is already engaged in your sector. Pitching your idea to investors who focus on your domain increases the chances of a successful partnership. Investor websites usually highlight their areas of interest.

- Investment stage. Investors may focus on different stages of business — from early-stage startups to late-stage ventures. While aligning with an investor specializing in your stage is beneficial, some investors may step outside their preferred stage for an outstanding opportunity.

- Average investment. There’s often a correlation between an investor’s total fund size and the average size of their investments. If you’re raising a relatively small seed round, a billion-dollar fund may not be the best match and vice versa.

- Location. While some investors have a global reach, others may focus on a particular region, especially for early-stage companies. It might be practical to concentrate on local investors at first and then widen your scope as your business expands.

- Network. Your existing contacts could be an invaluable resource. Identify potential investors in your network and ask for introductions. Other entrepreneurs, mentors, advisors and even friends and family could potentially help you connect with interested investors.

- Online platforms: Several platforms, such as AngelList, Crunchbase and LinkedIn, can help you find and research potential investors. We also highly recommend checking out Signal, a free web tool that lists and categorizes investors according to sector, stage, location and other factors.

- Long-term perspective: Since you’ll partner with your investor for years to come, ensuring an excellent personal fit is essential. An ideal investor understands your business, offers valuable advice, leverages their network and commits to putting in the work. Checking references from other portfolio companies can provide insights here.

Organize your list in a shareable document and request feedback from advisors and co-founders. Create columns and track your progress with each investor to ensure your efforts are targeted and your time is well-spent.

Next, apply rigorous filters to your list. Exclude funds that majorly focus on series A or later, are cash-strapped or are still in the process of raising their fund. Rule out anyone from a VC fund that hasn’t led and closed a seed deal within the past six months or already backs one of your competitors.

How to raise seed funding: A step-by-step guide

Raising seed funding can seem onerous, especially for first-time entrepreneurs. Whether you’re still in the idea phase or have a fully operational business looking for an injection of capital, these steps can help you navigate the journey of seed fundraising.

1. Planning your finances

“If you come in with a theory, and a plan and no data and you’re 1 of the next 1000, it’s going to be far, far harder to raise money.” — Marc Andreessen, co-founder and general partner of Andreessen Horowitz

First, turn your attention toward financial planning. Investors need to see that you have a clear understanding of your financial needs, a strategic plan for their investment and potential for profitable returns.

- Estimating seed funding requirements: Calculate your operational costs, product development costs, marketing and sales expenses, legal and administrative costs and a contingency fund. These calculations will help you determine the amount of seed funding you need.

- Planning fund allocation: Decide how to allocate the funds strategically. Prioritize areas that will drive growth and prove your business model, such as product development, hiring, marketing, sales and business operations.

- Creating financial projections: Prepare financial projections for the next three to five years, including revenue, expense and profitability projections, as well as cash flow statements. Although these are estimates, they should be realistic and based on solid assumptions.

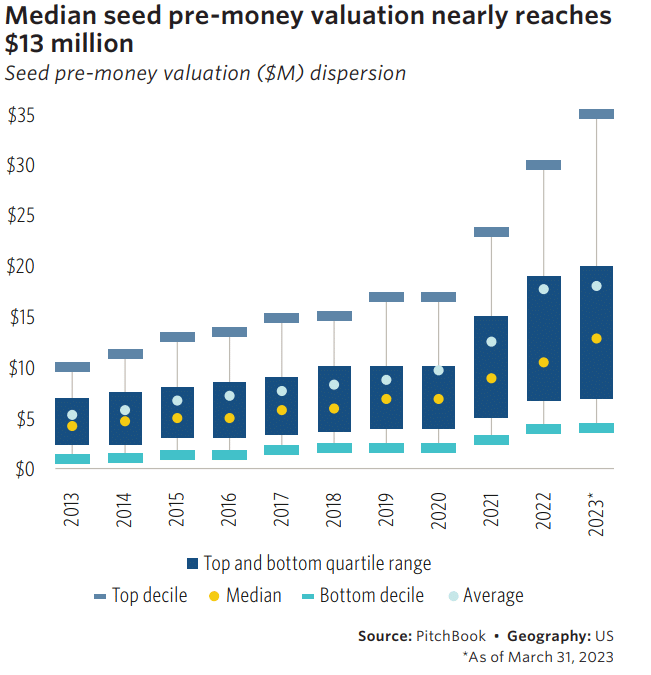

Seed round valuations

Valuing a startup is a guessing game, especially when you’re in the early stages of growth and actual revenue numbers are relatively small. Aim low until you gather more investor attention, at which point your valuation should naturally increase. Seed valuations often range between $2 million to $10 million, although that figure has increased in recent years. As per PitchBook’s data on U.S. VC valuations, the average seed pre-money valuation was $12.9 million in the first quarter of 2023.

Source: U.S. VC Valuations Report, Q1 2023, PitchBook

Common early-stage startup valuation methods

You should also familiarize yourself with the methods typically used to set a valuation for early-stage startups:

- Scorecard valuation method: This method compares your startup to other recently funded startups, considering factors such as the size of the market and the product or technology’s novelty. The sum is adjusted according to your region’s average valuation of recently funded startups.

- Cost approach: This process involves determining how much it would cost to build your startup from scratch today, considering aspects such as development time, assets acquired, technology built and talent hired. This approach can sometimes underestimate the company’s potential, as it doesn’t consider future profitability or market demand.

- Market and investor sentiment: Ultimately, valuation is as much an art as a science. Market conditions and investor sentiment play significant roles in setting a startup’s value. During a buoyant market, investors might be willing to pay more, and vice versa. Similarly, if investors are particularly excited about your industry or your team, they may value your company higher.

2. Creating an investor deck

“Having a great startup pitch has more to do with setting up and running a great company than optimizing some type of sales process to investors. Great investors can see through most tactics that you will use in the pitch process, so the best fundraising strategy is to build a great company.” — Ken Howery, co-founder of PayPal and Founders Fund

An investor deck, or a pitch deck, is a presentation that startups use to give potential investors a brief overview of their business plans during fundraising rounds. It is your opportunity to showcase your vision, strategy, financials, team and investment opportunity.

The length of a pitch deck can vary, but most successful decks contain between 10 to 15 slides. According to Visible’s data analysis, pitch decks with a 100% viewer completion rate included, on average, 12.2 slides. This length is typically enough to cover the key points without overwhelming your audience.

A well-structured investor pitch deck for seed fundraising typically includes these nine slides:

- Company overview: Start with an engaging summary of what your company does and your mission.

- Problem and solution: Clearly define the problem your product or service solves. This slide gives investors a sense of the market need for your offering.

- Product: Demonstrate your product or service’s functionality and unique selling proposition (USP).

- Market analysis: Detail your target market, size and how much you aim to capture.

- Business model: Explain how you plan to make money and achieve sustainable growth.

- Marketing and sales strategy: Describe how you intend to attract and retain customers.

- Team: Highlight your team’s background and skills, showcasing how you’ve gathered the right group to execute this business plan.

- Financial projections: Provide a snapshot of your projected revenue, profitability and financial needs over the next three to five years.

- Ask: Clearly state how much funding you seek and how you plan to use the capital.

Investor pitch deck: Best practices

To deliver a genuinely compelling pitch deck, remember these tips:

- Ensure your message is clear and concise. Avoid jargon and aim to make your pitch understandable to anyone, regardless of their industry knowledge.

- Use high-quality graphics, charts and images to keep your audience engaged. Avoid cluttered slides and small fonts. Consider hiring a graphic designer so everything looks polished.

- Use a narrative structure that takes your audience on a journey. Engaging stories can make your pitch more memorable and compelling. Showcase your journey so far or highlight one of your customer success stories.

- Support your claims with credible data and metrics. This information can significantly improve your credibility and trustworthiness.

B2B SaaS pitch deck example

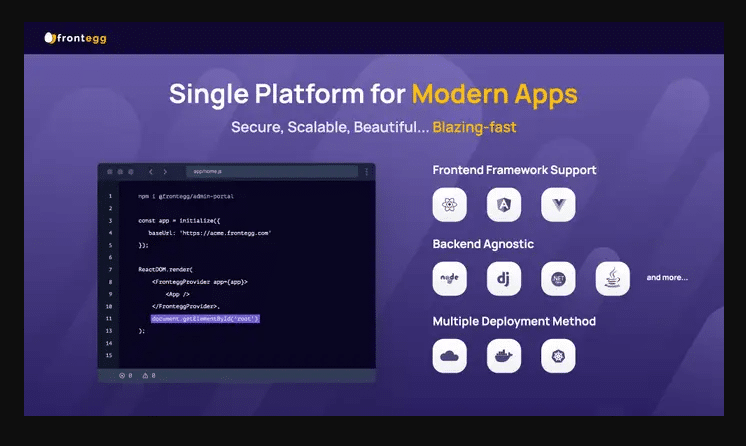

Let’s consider a real-world example: Frontegg’s pitch deck, which helped this B2B SaaS startup showcase a high-growth, high-return investment opportunity and secure $25 million in a funding round led by Insight Partners.

As highlighted in a Business Insider article, Frontegg’s pitch started with a solid overview highlighting their unique value proposition, demonstrated the problem and their innovative solution and wrapped it all up by showing a robust product-led business model and exciting future plans.

3. Reaching out to potential investors

Your path to investors often starts with networking. When reaching out to potential investors for the first time, keep it short and relevant. If you’re being referred and they ask you to provide a promotional piece to forward, resist the temptation to include excessive details. A concise introduction suffices.

Once the VC shows interest, the referral process ends, and the pitching begins. At this point, be ready to pitch to any team member of the VC firm, irrespective of their role or title. Principals and associates may not lead deals, but their opinions are still heard.

During your initial conversations, seize the opportunity to qualify the prospective investor. Confirm if they are actively leading seed rounds and their typical investment focus. Ask about their last three deals to gauge if your business is a fit for them.

You can also use the following strategies to help you make meaningful connections and find investors:

- Industry events and conferences: Participate in startup events, industry conferences and pitch competitions. These platforms offer an opportunity to present your business to a broader audience and meet potential investors.

- Online networking platforms: Use professional networking sites such as LinkedIn to connect with potential investors and influencers in your industry. Ensure your profile is updated and reflects your venture’s value proposition.

- Social media engagement: Actively promote your startup’s story and progress on social media platforms. Regular updates can draw attention and demonstrate momentum, which can attract potential investors.

- Share of voice (SOV) and thought leadership: Aim to establish your startup and yourself as thought leaders in your industry. Publish informative content, engage in meaningful discussions and share your insights and ideas on platforms where your potential investors are likely to be.

How to prepare for investor meetings

Before any initial meeting or call with an investor, preparation is critical:

- Understand their investment focus, portfolio companies and past investments. This knowledge will help you tailor your pitch to their interests and anticipate their questions.

- Be ready to discuss key financial aspects of your business, including revenue, profitability, customer acquisition cost and projected growth.

- Investors invest in people as much as ideas. Take the time to discuss your team’s background, skills and why you picked them.

- Investors will likely challenge your business model, market and strategy. Practice answering tough questions concisely and confidently.

👉 A sign that your investor meeting is going well is if they are talking as much as you are. Remember, you are there to have a conversation, not deliver a monologue. Even if investors say no, get any feedback you can from them.

4. Preparing for investor due diligence

During the due diligence process, potential investors closely examine your startup before making their decision. It allows the investors to validate the information presented during pitches and discussions, verify your startup’s compliance with laws and regulations and assess its growth and return on investment potential.

Due diligence typically includes an analysis of various aspects of your business:

- Financial: Due diligence includes reviewing financial statements, understanding revenue streams, analyzing expenses, scrutinizing cash flow and assessing existing debt. It’s an opportunity for investors to validate the financial robustness of your business and its future profitability.

- Legal: The process involves a thorough review of the legal aspects of the startup, including understanding the company’s legal structure, reviewing contracts and agreements with clients, suppliers and employees, assessing intellectual property rights and checking compliance with relevant laws and regulations.

- Business and operational: Investors delve into your business model, strategies, operational processes, market potential, competitive landscape, customer base and the quality of products or services. This part is their opportunity to understand the inner workings of your startup.

- Managerial: Investors often also consider the management team to be one of the most critical aspects of a startup and will assess their skills, experience and commitment to deliver on the business plan.

How to prepare for investor due diligence

Due diligence can be an invasive process. Still, preparation significantly helps demonstrate investment readiness:

- Ensure all your business documents are organized, updated and readily available. The list includes financial statements, business plans, contracts, legal documents, employee records etc.

- Be ready to justify your financial projections. Ensure that they are based on realistic assumptions and that you can explain any significant expected revenue, costs or cash flow changes.

- Verify that your business complies with all relevant laws, regulations and industry standards. You might require consulting with a legal advisor to understand potential compliance issues.

- Prepare your team for possible interviews or interactions with investors. Ensure everyone knows what the company’s mission, vision and goals are.

Investors showing real engagement often send you questions, make efforts to visit your office, peruse your startup data room, conduct thorough reference checks, speak to your customers and partners and even potentially set up new customer or strategic partner visits. As these engagements deepen, the likelihood of them funding your startup increases.

Your ultimate goal, however, should not be to secure just one term sheet but to receive multiple term sheets in the same week, a feat that requires dexterous juggling. To do so, it’s essential to track your investor pipeline continuously, keep adding prospects at the top of your funnel and maintain contact with at least five or six funds until you secure a signed term sheet.

5. Negotiating the deal

“The No. 1 rule in any negotiation is don’t take yourself hostage. People do this to themselves all the time by being desperate for ‘yes’ or afraid of ‘no,’ so they don’t ask for what they really want. Instead, they only ask for what they can realistically get.” — Christopher Voss, author of “Never Split the Difference” and former FBI hostage negotiator

Negotiating a favorable deal is perhaps the most important and tricky part of raising seed funding. This step not only defines the immediate financial support your startup will receive but also influences future financing rounds, the power dynamics within your business and your startup’s strategic direction.

Negotiating with investors requires a careful balancing act. Below are key pointers to remember:

- Know your worth: A clear understanding of your startup’s valuation is necessary. This isn’t just about numbers; it’s about the value you offer, your startup’s potential and how convincingly you can portray it to investors. Research, talk to advisors and be prepared to withstand the scrutiny of the negotiation process.

- Consider the other perspective: While you’re passionate about your startup’s potential, remember that investors primarily seek a return on their investment. They will think about everything in terms of risk and potential returns.

- Be flexible but don’t compromise: Be open to discussions and potential changes in terms. However, also know your non-negotiables — the terms you’re unwilling to budge on because they might jeopardize your startup’s interests.

- Have legal counsel you trust: Legal jargon can be overwhelming. Always seek legal counsel to understand the implications of the terms being negotiated. A good lawyer can help you avoid unfavorable conditions and understand the long-term consequences of your deal.

Managing investor partnerships

Successful partnerships require you to balance your interests with those of your investors:

- Often, a key point of negotiation is how much equity to give away. While investors may seek significant equity for their investment, how much control you want to surrender is ultimately up to you. At the same time, after the round, some investors want to be actively involved, while others prefer a hands-off approach. Clear understanding and agreement on this aspect are necessary to avoid conflicts in the future.

- Investors will be interested in the exit strategy, looking for assurance of a clear path to realizing a return on their investment. Ensure that your interests align with their expectations.

- Partnering with investors who share your long-term vision for the company will lead to a more harmonious and productive relationship. They’re not just providing capital but also potentially offering expertise, industry connections and mentorship.

The terms you get will be shaped by factors within your control, such as how you run your process, how many term sheets you attract and how aggressive you try to be on price. Terms will also be affected by factors outside your control, for example, whether your company is in a hot sector and the state of the capital markets.

It’s worth emphasizing that long-term success is paramount and short-term dilution secondary. If you must choose between a low valuation with a clean term sheet or a high paper valuation with a problematic term sheet, opt for the former, even if it implies more dilution.

Term sheets: A quick overview

A term sheet is a non-binding agreement that outlines the basic terms and conditions under which an investment will be made. The draft serves as a template to develop more detailed legally binding documents and sets the groundwork for ensuring all parties agree on the broad strokes of the investment terms. Although it’s not a legal commitment, it signifies a serious intention to conduct certain business transactions.

The term sheet comes into play during the negotiation phase of seed fundraising, which typically occurs after a potential investor expresses a serious interest in investing in your startup. After several discussions or pitches, if the investor sees a promising opportunity in your startup, they may issue a term sheet. Familiarity with the essential components of a term sheet is imperative, which include:

- Valuation: The company’s valuation is a principal aspect of a term sheet. It can be pre-money (the valuation before the investment) or post-money (the valuation after incorporating the new investment). The valuation type used must be clarified with the investor to avoid confusion, as different VCs might use either or both types. The company’s valuation will determine the percentage of the company’s equity the investor will receive in return for their investment.

- Investment amount: The amount of money the investor has committed to put into the startup.

- Equity stake: The percentage of the company the investor will own after investing.

- Type of stock: Early-stage investors often prefer purchasing “preferred stock,” which comes with unique terms and conditions not applicable to common stockholders. It includes voting rights that can be unevenly distributed, favoring preferred stockholders. It also gives them a higher position in the debtor hierarchy, ensuring their investment is recovered before other stockholders should the company go under.

- Liquidation preference: This provision defines the payout order in the event of a liquidation, sale or bankruptcy of the startup. Typically, investors with a liquidation preference get paid before common stockholders.

- Voting rights: These rights detail the decision-making power of the investor, including the matters on which they can vote. The term sheet can stipulate that certain actions need approval either by a preferred or common majority, affecting corporate policy-making and control.

- Option pool: The equity reserved for future hires is reflected in the option pool. A good rule of thumb for most startups is to set aside 10-15% of stocks in the option pool.

- Founder vesting: This process allows startup founders to “earn” their shares over time, encouraging them to stay with the company and keeping the stock within the company if a founder decides to leave early.

- Anti-dilution protection: This provision protects the value of the investors’ equity if the startup raises additional funding at a lower valuation than the previous round.

- Redemption rights: VCs may request redemption rights, providing them an option to have their outstanding shares redeemed by the company at a predetermined price.

- Pro-rata Rights: These rights entitle an investor to participate in future funding rounds to maintain their percentage ownership in the company. For example, if an investor owns 10% of the company, pro-rata rights allow them to invest an additional amount in the next funding round to keep their ownership stake at 10%, even as more shares are issued.

- Drag-along and tag-along rights: With drag-along rights, majority shareholders can force minority shareholders to take part in the sale of the company. Tag-along rights allow minority shareholders to participate in a deal if majority shareholders sell their stake.

- Confidentiality and exclusivity: Some term sheets may include clauses that prevent the founders from sharing the term sheet details with others or seeking investment from other parties for a specific period.

Closing a seed round and the next steps

Don’t assume your fundraising round ends after signing a term sheet. There’s still a considerable amount of work to do to reach the final closing, and multiple financing paths can be taken, depending on the size of your round. You may lean toward using a convertible note or a simple agreement for future equity (SAFE) for smaller amounts. These instruments are relatively straightforward, quick to close and require minimal legal work.

The simplicity of these convertible notes and SAFEs might create misalignments. As these instruments are essentially debt, they have a priority claim on the company’s assets, potentially jeopardizing its position in the event of failure to raise future funds. For more significant amounts, such as $1 million or higher, it is advisable to opt for equity investment, even though it involves more legal paperwork and a longer close time.

Whether you use a convertible note or an equity round, your legal counsel is essential in the closing process. A seasoned lawyer will guide you through drafting the closing documents or, in the case of an equity round, navigating the complexities of due diligence, document preparation and negotiation. Keep emotions in check and maintain open communication with your VC partners, ensuring any misunderstandings are quickly addressed.

Once the final check is received, you’ve successfully closed your seed round. Celebrate this milestone, but remember, raising capital is not an end in itself; it’s a means to achieve your greater business goals. Emphasize a culture of frugality and focus on using this capital to drive future growth and success.

Post-seed funding objectives

“When it rains, you open an umbrella.” — Masayoshi Son, CEO of SoftBank Group

Once a startup has successfully raised and closed its seed funding round, it enters a critical phase of its lifecycle. Your next steps will be closely scrutinized, and you’ll need to meet certain milestones to make it to your next funding round. You’ll have to:

- Define your roadmap: Now that you have a capital injection, you’ll have to refine your organizational roadmap. Align your team with clear objectives that create value and reflect your promises to investors during fundraising.

- Build your team: People are the backbone of your startup, and securing seed funding allows you to hire the personnel you need. Make strategic hires or find partners that fill skill gaps in your team.

- Manage your burn rate: With new capital comes the responsibility of prudent financial management. Keep an eye on your cash burn rate — the rate at which you spend money before it generates positive cash flow. Maintain a balance between investing in growth and preserving the runway.

- Accelerate product development: Seed funding often speeds up product development, enabling you to move from prototype to production, enhance features or invest in quality and user experience. Customer feedback should guide your iterations — stay close to your market and be responsive to its needs.

- Market and sell: With a solid product or service, your startup should focus on customer acquisition and scaling sales. This step involves investing in marketing, sales personnel and customer relationship management tools. Your go-to-market strategy should be flexible, allowing you to respond to market dynamics and feedback.

- Stay agile and resilient: In the startup world, agility is everything. Be ready to pivot if necessary and learn from both successes and failures.

👉 Check out this popular guide on product-led growth to understand the far-reaching benefits of excellent product development.

Fuelling your post-seed growth journey

As the dust settles on the hustle and bustle of your seed fundraising, the gaze shifts from the bank balance to the playing field — executing your vision and converting your financial fuel into business traction. We can help with that.

As a B2B growth consultancy, we specialize in navigating tech startups through the digital terrain, deploying SEO strategies to turn complex challenges into tangible growth. Rich and value-driven content allows us to drive your message home, control the narrative and build brand influence in the ultra-competitive B2B SaaS market.

But we aren’t just about generating leads; we’re about generating the right leads — quality over quantity. We’ll pick out the keywords worth your money for organic and paid campaigns while tuning your site for conversion rate optimization (CRO). Our web and design services equip your digital environment not just with aesthetics but with a potent mix of usability and functionality, geared toward driving conversions and business results.

Want to see your competition in the rearview mirror? Reach out to discuss your growth goals.